What is a Cap Rate Calculator Website?

A Cap Rate Calculator website is an online tool that allows users to easily calculate the capitalization rate of an investment property. By entering key details such as the property value, annual gross income, and operating expenses, the website quickly provides the cap rate, offering valuable insight into the potential return on investment. This tool is especially useful for real estate investors who want to compare properties or evaluate how much profit they can expect. The calculator simplifies the process, delivering accurate results without needing complex financial expertise.

What is Cap Rate?

The Capitalization Rate (Cap Rate) is a metric used in real estate to determine the rate of return on an investment property. It is calculated by dividing the property's annual net operating income by its current market value. The cap rate helps investors assess how much income a property will generate relative to its cost, providing a quick comparison between investment opportunities. A higher cap rate typically indicates a better return on investment, although it may come with higher risk. Investors use the cap rate to make informed decisions about property purchases and potential profitability.

How to Use the Cap Rate Calculator Website?

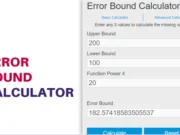

Using the Cap Rate Calculator is simple. Start by entering the property value, annual gross income, and operating expenses percentage. Then, input the vacancy rate percentage to account for periods when the property is unoccupied. Once you have entered all the required values, click the "Calculate Cap Rate" button. The calculator will instantly display the operating expenses, annual net income, and cap rate. Additionally, the website provides a step-by-step breakdown of the formula used and how the cap rate is calculated. Clear the fields using the "Clear" button for new calculations.

Calculate Cap Rate

FAQs-

1. What is Cap Rate in Real Estate?

Cap rate is a percentage used by real estate investors to measure the return on investment (ROI) of a property. It is the ratio between a property's net operating income (NOI) and its market value. A higher cap rate indicates a higher return but may also suggest more risk. The cap rate formula helps investors compare different properties, assess their profitability, and make informed decisions about buying or selling real estate assets.

2. How is Cap Rate Calculated?

The cap rate is calculated using the formula: Cap Rate = Net Operating Income (NOI) / Property Value. The net operating income is the income the property generates after subtracting all operating expenses, such as maintenance, insurance, and utilities. The property value is its current market price. This calculation helps real estate investors determine the potential return on investment for the property.

3. What is a Good Cap Rate?

A good cap rate depends on market conditions and the type of property being evaluated. Generally, cap rates between 4% and 10% are considered acceptable. Lower cap rates (around 4-6%) may indicate lower risk but also lower returns, while higher cap rates (8% or more) could suggest higher risk with higher returns. Investors must assess cap rates in the context of the property location and overall investment goals.

4. What is Net Operating Income (NOI)?

Net Operating Income (NOI) is the total income generated from a property after deducting all operating expenses but before mortgage payments, taxes, and other non-operating costs. It is used to calculate the cap rate and helps investors evaluate the profitability of an investment property. NOI includes income from rent, minus expenses like insurance, maintenance, and property management fees.

5. What are Operating Expenses?

Operating expenses refer to the costs required to maintain and operate a property. These include expenses such as utilities, insurance, repairs, property management fees, and maintenance. However, they do not include mortgage payments, income taxes, or depreciation. Operating expenses are an important factor in calculating the net operating income (NOI) and, in turn, the cap rate.

6. What is Vacancy Rate?

Vacancy rate is the percentage of time a rental property remains unoccupied during a given period, usually a year. It is an important factor in calculating the net operating income (NOI) since vacancies reduce the rental income generated by the property. A lower vacancy rate generally indicates higher occupancy and more reliable rental income, while a higher vacancy rate may suggest challenges in finding tenants.

7. How Does Vacancy Rate Affect Cap Rate?

The vacancy rate affects the cap rate by reducing the net operating income (NOI). As the vacancy rate increases, the NOI decreases because the property is generating less rental income. Since the cap rate is calculated by dividing the NOI by the property value, a lower NOI results in a lower cap rate. Therefore, a high vacancy rate negatively impacts the overall return on investment (ROI) of a property.

8. Should Cap Rate Include Mortgage Payments?

No, cap rate calculations do not include mortgage payments. The cap rate focuses on the property's operating income before financing costs are considered. This allows investors to assess the profitability of a property independent of how the purchase is financed. Mortgage payments and other financing costs are considered separately when calculating metrics like cash-on-cash return.

9. What is a Cap Rate Used For?

A cap rate is used by real estate investors to evaluate the potential profitability of an income-generating property. It helps investors compare properties of different values and income streams to decide whether a property is a good investment. The cap rate provides a simple and clear measure of the return on investment based on the property's current market value and net operating income (NOI).

10. How Often Should I Calculate Cap Rate?

Cap rates can be recalculated periodically, especially if there are changes in property income, expenses, or market value. Investors often calculate cap rates when evaluating potential acquisitions, during annual reviews of investment performance, or when considering the sale of a property. Keeping track of cap rate changes can help you make informed decisions about real estate investments over time.

11. Can Cap Rate Be Negative?

Yes, cap rates can be negative if the property generates a negative net operating income (NOI), meaning the operating expenses exceed the income generated from the property. Negative cap rates indicate that the property is not profitable and may signal a poor investment or a need for significant changes in how the property is managed or rented out to become profitable.

12. What Is the Difference Between Cap Rate and ROI?

Cap rate measures the return on investment (ROI) of a property based on its net operating income (NOI) and market value, while ROI generally includes all forms of investment returns, such as appreciation and financing costs. Cap rate focuses solely on the operating income, making it a helpful tool for comparing income-generating properties, while ROI provides a more comprehensive view of the overall return on investment.