ERA Calculator

What is the ERA Calculator Website

This website provides a simple tool to calculate a pitcher's ERA based on the number of earned runs and innings pitched. By entering these two values, users can quickly and accurately determine the pitcher's performance level. The ERA Calculator is ideal for baseball players, coaches, and fans who want to analyze and understand pitching effectiveness in games.

What is ERA

ERA, or Earned Run Average, is a key baseball statistic that measures a pitcher's performance by calculating the average number of earned runs they allow per nine innings pitched. A lower ERA indicates better performance, as it means the pitcher allows fewer runs. It is an important metric used by coaches, scouts, and analysts to evaluate pitchers and compare their effectiveness.

What is the ERA Calculator Website

This website provides a simple tool to calculate a pitcher's ERA based on the number of earned runs and innings pitched. By entering these two values, users can quickly and accurately determine the pitcher's performance level. The ERA Calculator is ideal for baseball players, coaches, and fans who want to analyze and understand pitching effectiveness in games.

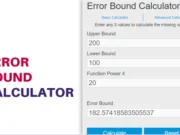

How to Use the ERA Calculator Website

To use the ERA Calculator, enter the number of earned runs the pitcher has allowed and the total number of innings they have pitched in the respective fields. Click the 'Calculate ERA' button to instantly view the calculated ERA. If you want to reset the fields and start over, simply click the 'Clear' button. The tool is user-friendly and provides quick results to help you analyze a pitcher's performance.

Calculator

Result

Calculation Steps

1. What is an ERA Calculator?

An ERA Calculator is a tool used in baseball to calculate the Earned Run Average of a pitcher. This statistic measures the average number of earned runs a pitcher allows over nine innings pitched. It helps to evaluate a pitcher’s effectiveness by determining how many runs they give up, without accounting for fielding errors. A lower ERA is generally better, indicating strong pitching performance.

2. How is ERA calculated?

ERA is calculated by dividing the total number of earned runs allowed by a pitcher by the total number of innings pitched and then multiplying the result by nine. The formula is: ERA = (Earned Runs / Innings Pitched) * 9. This calculation normalizes the number of runs given up to a standard nine-inning game, making it easier to compare different pitchers.

3. Why is a lower ERA better?

A lower ERA indicates that a pitcher is allowing fewer earned runs, which generally means they are performing better. It suggests that the pitcher has more control and is more effective at preventing the opposing team from scoring. A low ERA is often a sign of a strong pitcher who can consistently perform well over many games.

4. Can ERA be used for all levels of baseball?

Yes, ERA is a universal statistic used at all levels of baseball, from Little League to Major League Baseball. It provides a standardized measure of a pitcher's effectiveness, making it a valuable tool for coaches, players, and scouts to assess performance across different leagues and competitions.

5. What is a good ERA?

A good ERA varies depending on the level of play and the context of the season. In Major League Baseball, an ERA below 3.00 is considered excellent, between 3.00 and 4.00 is above average, and anything above 4.00 is considered average or below. For younger players, the benchmarks might differ based on their developmental stage.

6. Does ERA account for all runs scored?

ERA only accounts for earned runs, which are runs scored without the aid of defensive errors or passed balls. It does not include unearned runs, which result from fielding mistakes. This focus on earned runs helps isolate the pitcher's performance from the fielding performance of the defense behind them.

7. Is ERA the only measure of a pitcher's performance?

No, ERA is just one of many statistics used to measure a pitcher's performance. Other important metrics include WHIP (Walks and Hits per Inning Pitched), strikeouts, and walks allowed. Each of these metrics provides different insights into a pitcher's overall effectiveness and ability to control the game.

8. How can ERA be misleading?

ERA can be misleading if not considered in the proper context. For example, pitchers who pitch in hitter-friendly parks or against strong lineups may have higher ERAs through no fault of their own. Additionally, small sample sizes early in the season can skew ERA figures, making it important to consider other stats and longer-term trends.

9. How does ERA compare to FIP?

ERA and FIP (Fielding Independent Pitching) are related but different metrics. While ERA measures the actual earned runs allowed, FIP estimates a pitcher's effectiveness at preventing home runs, walks, and strikeouts, ignoring the effects of defense and luck. FIP is considered a better predictor of future performance than ERA in some cases.

10. Can relief pitchers have different ERA expectations?

Yes, relief pitchers often have different ERA expectations compared to starting pitchers. Since relievers typically pitch fewer innings and are used in more specialized situations, their ERA can vary more widely. In general, a reliever with an ERA below 3.00 is considered quite effective, while starting pitchers often have slightly higher benchmarks.

11. What other advanced stats are related to ERA?

Other advanced stats related to ERA include xERA (Expected ERA), which uses statcast data to predict future performance, and ERA+ (ERA adjusted to the league average and ballpark factors). These metrics provide more context and can give a clearer picture of a pitcher’s abilities beyond what traditional ERA might suggest.

12. How often should ERA be calculated?

ERA can be calculated as often as needed to evaluate a pitcher’s performance, typically after each game or series of games. For accurate assessment, it’s best calculated over a longer period, such as a season, to account for variations and provide a more stable measure of a pitcher’s effectiveness.

Related Calculator-